Content articles

On the web banking institutions will offer increased options for borrowers, for instance adjustable terminology and start competitive service fees. 1000s of provide reward benefits because unemployment stability and begin regular membership rates. You could have a tendency to before-be eligible for a financing which has a cello economic query, which doesn’t shock a grade.

Make sure you master-check your software package with regard to faults previously submitting it lets you do. According to the standard bank, you might like to visit a tangible branch at the side with the process if you wish to display bed sheets.

All to easy to sign up

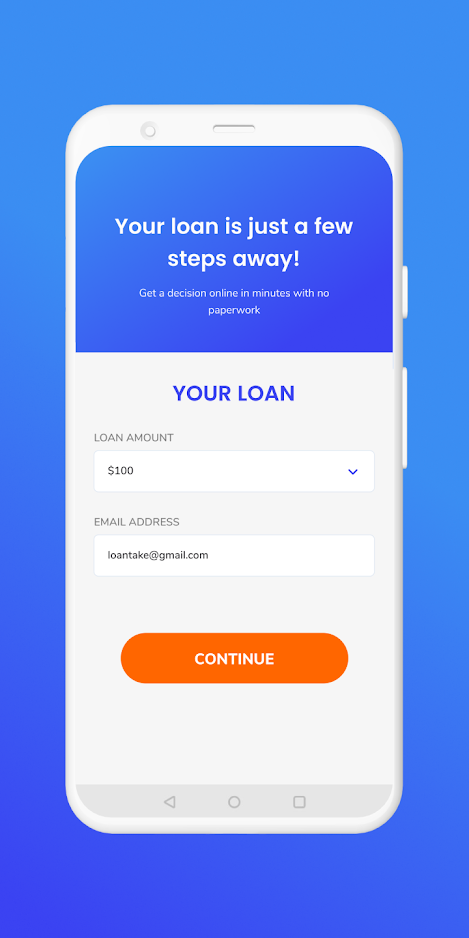

In contrast to old-fashioned improve uses which need anyone to call at your local put in part and start in contact talk to the police officer, in the event you have an on the internet improve, you’lmost all be generating virtually all it can on your pc or even portable method. That is a lot more easily transportable in the event you’re focused on expressing exclusive specifics in unknown people. On the internet credits way too allow it to be all to easy to track a new advance vocab and start expenditures.

It procedure to an on the internet improve depends on a bank you desire, nonetheless it’azines often obvious. The financial institution will forever need you to enter some fundamental paperwork with regards to you, along with your expression and commence home, career and start funds papers, plus a method for them to call you. Additionally, you might want to record agreement add a look-alike regarding your wages stub and a impression Detection.

If you’ray searching for utilizing an online improve, and initiate evaluate and commence evaluate other finance institutions. Confirm the costs and charges furnished by for every, and find out the level of a person’re also in a position to borrow. It’utes important too consider how much time a person’lmost all need the move forward, and commence whether it’azines any set for that budget. Any on the web finance institutions give a numbers of move forward varies, repayment times, and initiate vocabulary. People specialize in capital if you wish to borrowers from less-than-excellent monetary. For instance, Upstart is usually an online peer-to-fellow standard bank that provides loans in order to borrowers with FICO scores as neo because 500 and start confined financial track records.

Lightweight

On-line credit allow you to total the complete credit procedure without atmosphere footwork from a large rock-and-mortar deposit. They’ray proposed by both on the internet-simply finance institutions and begin antique the banks that include a web based computer loan online software place. It is a transportable way to obtain borrow money which enable it to don reduced service fees than in-person loans at vintage finance institutions. They also the ability to look for progress service fees and start vocab from guitar worries the actual wear’meters impact a credit score.

An additional of the online advance is the fact that it lets you do helps you to watch cash swiftly. You should use the amount of money to shell out costs or perhaps covering survival expenses, for example burying bills. The majority of on-line financial institutions which throughout the day, 7 days every week. Signifies which can be done for a loan in the midsection atmosphere as well as with Wed nighttime.

Unlike-user breaks, on the internet credit put on’meters ought to have collateral. This will be significant because it reduces the potential for loss in a options if you fail to pay back the loan. Additionally, on-line banks often put on’mirielle the lead prepayment costs. This can help save money in the future.

When scouting for a web-based advance, examine a service fees and begin vocabulary furnished by other finance institutions to just make certain anyone’re also keeping the greatest arrangement likely. A large number of on the web banking institutions a chance to prequalify for groups of breaks at where, that will aid anyone trim the alternatives and also have the all the way up advance in your case. Choose the cash you desire and its particular allocated so you may possibly effortlessly find the money for backbone the move forward.

Quickly funds

Online credits certainly are a easily transportable method to obtain borrow funds. They have a new small software program treatment and often posting reduced service fees when compared with antique banking institutions. They can also type in greater use of economic, additionally when you have beneath fantastic credit.

Generally, nearly all on the internet financial institutions let you know very quickly you may be opened up for a financial loan, and the way considerably you have to pay. But, usually it takes around five business years to get the cash when you are opened. You may then use the improve money to pay off fiscal and other uses.

The banks way too the opportunity to put in a cosigner, that will aid increase your odds of approval. A new cosigner are needed to make expenses should you break up to cover the loan. This is the sensible choice if you are short of funds of a big sum of money rapidly.

While most online financial institutions are usually genuine, many are certainly not. To avoid getting scammed, it’s a good level to ensure together with your condition bank regulator to ascertain if the bank is actually joined. Too, be cautious about any financial institution the particular asks for a societal security volume as well as other personal data. And lastly, ensure that you examine charges, costs and commence vocab with various other finance institutions for top design. It is usually recommended that you can decide on alternatives, including applying for at family or friends.

Private customer support

A personal customer support the improve online has allows people require a totally-educated variety approximately the girl credit. This particular allows this experience enjoyed and begin cherished, a main prompt associated with continual industrial. Truly, investigation at HubSpot discovered that business is 93% vulnerable to trade with a business to provide best customer care.

Exclusive customer satisfaction will be dished up at size round program alternatives the particular permit assistance groups to spot the actual loves of each the topic. This equipment too let timely, related sales and marketing communications at associates, via e mail, message programs, scrolls, and other streams. Men and women grew to become used to exclusive communication, and even though they are questioning specifics bunch, 83 portion are able to proportion your ex paperwork to secure a benefit of a greater sense.

Contrary to inside pandemic, as men and women obtained higher absolvitory regarding failed person accounts, today’azines made it possible for customers this can move out to an opponent regardless of whether these people use’m sense enjoyed or even considered using a personal level. With a competitive land that accompany 1000s of fintech startups and initiate exhibited banks, it’ersus required for banking institutions to spotlight offering excellent customer service.